Over the weekend, the U.S. Senate put out a new version of the budget reconciliation bill. It would change the commercial ITC to be based on project completion and not extend the Section 25D residential ITC beyond the end of this year. It would also create a new tax for systems not taking the ITC if a majority of the components come from China.

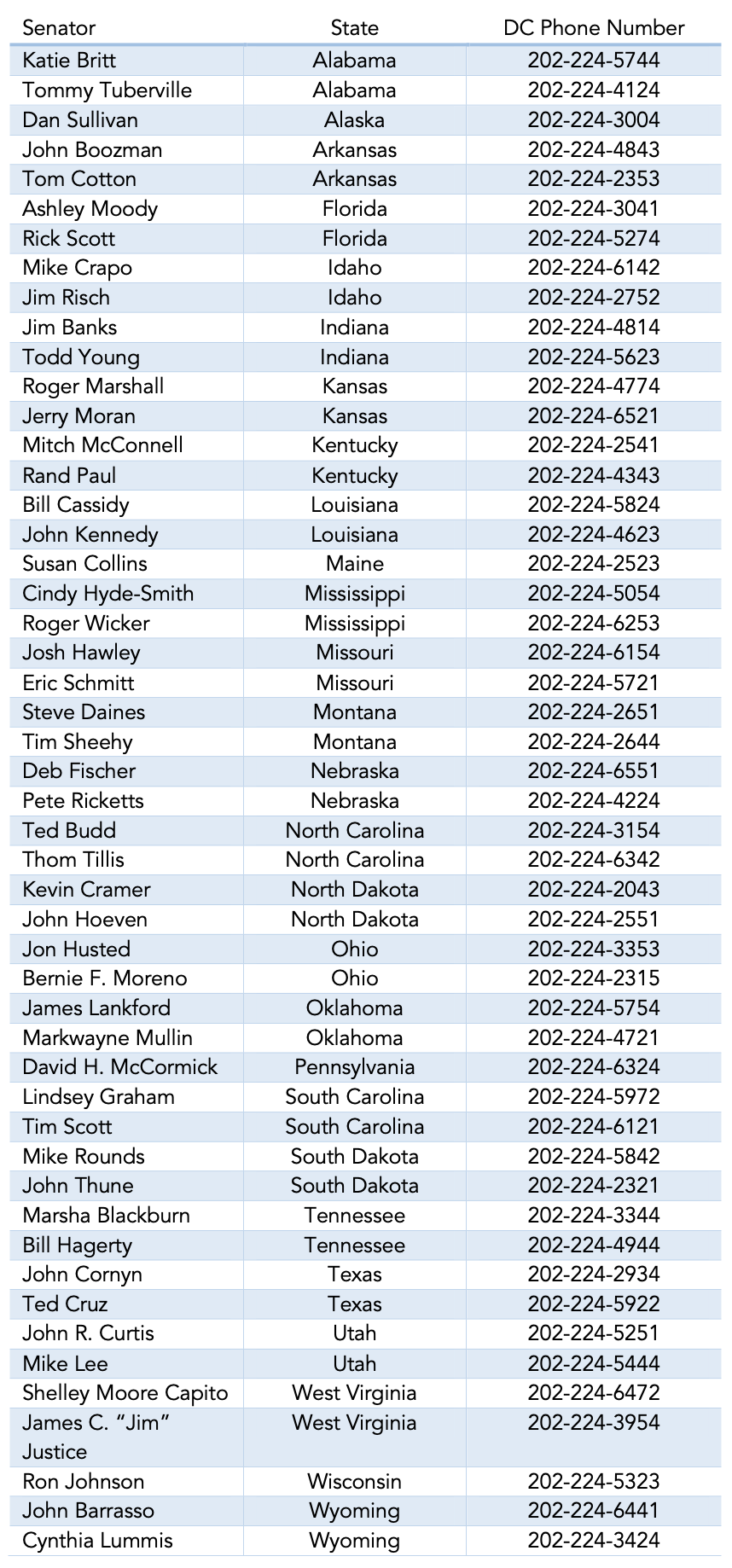

The Senate is debating amendments all day today, with a possible conclusion this evening.

Two amendments will be considered to help the solar tax credit.

Amendment 2704 (Ernst/Grassley/Murkowski) would take the commercial ITC back to eligibility based on the start of construction and remove the new tax.

Amendment 2719 (Hickenlooper) would extend the residential ITC for one year.